Book Notes: 7 Powers

7 Powers analyzes the statics and dynamics of business strategy.

Statics is about “Being There”. What makes a business so durably valuable? Dynamics is about “Getting There”. What developments yielded this attractive state of affairs in the first place?

Power is defined as the set of conditions creating the potential for persistent differential returns.

The author lists the 7 Powers as:

- Scale Economies

- Network Economies

- Counter-Positioning

- Switching Costs

- Branding

- Cornered Resource

- Process Power

Equations

The author defines a Fundamental Equation of Strategy as:

Value = Mgsm

Where:

M = current market size

g = discounted market growth factor

s = long term market share

m = long term differential margin

Each of the chapters on the 7 Powers also derive a Surplus Leader Margin for each of the Powers. Surplus Leader Margin is the profit margin the business with Power can expect to achieve if pricing is such that its competitor’s profits are zero.

Surplus Leader Margin is an important concept to think through. However, I found the equations more academic than pragmatic.

1) Scale Economies

Scale Economies is a business in which per unit cost declines as production volume increases.

The benefit is that you can offer a lower price to customers over time than your competitors can. And you can decrease investment over time faster than your competition.

2) Network Economies

Network Economies is a business in which the value realized by a customer increases as the installed base increases.

Network Economies business are, in general, winner-take-all. This creates a massive barrier to entry from competitors.

3) Counter-Positioning

Counter-Positioning is when a newcomer adopts a new superior business model with the incumbent does not mimic due to damaging their existing business.

I found this chapter be the best written and the most insightful. The author lists multiple reasons why an incumbent may not be able to challenge an upstart:

- Milking the old business or Negative Combined Net Present Value

- History’s Slave or having a Cognitive Bias against the new business

- Job Security or The Principal Agent Problem

4) Switching Costs

Switching Costs is when the value loss expected by a customer that would be incurred from switching to an alternate supplier for additional purchases.

There may be financial, procedural, or relational switching costs.

5) Branding

Branding is an asset that communicates information and evokes positive emotions in the customer, leading to an increased willingness to pay for the product. It is the durable attribution of higher value to an objectively identical offering that arises from historical information about the seller.

6) Cornered Resource

A Cornered Resource is preferential access at attractive terms to a coveted asset that can independently enhance value.

There are five tests to qualify as a Cornered Resource:

- Idiosyncratic. If a firm repeatedly acquires coveted assets at attractive terms, then the proper strategy question is, “Why are they able to do this?”

- Non-arbitraged. Price is not arbitraged away.

- Transferable. This resource could create value at another firm.

- Ongoing. Power remains over time.

- Sufficient. Continued differential returns.

7) Process Power

Process Power is company organization and activity sets which enable lower costs and superior product, and which can be matched only by an extended commitment.

Process Power equals operational excellence, plus hysteresis.

Power Intensity, Benefits, and Barriers

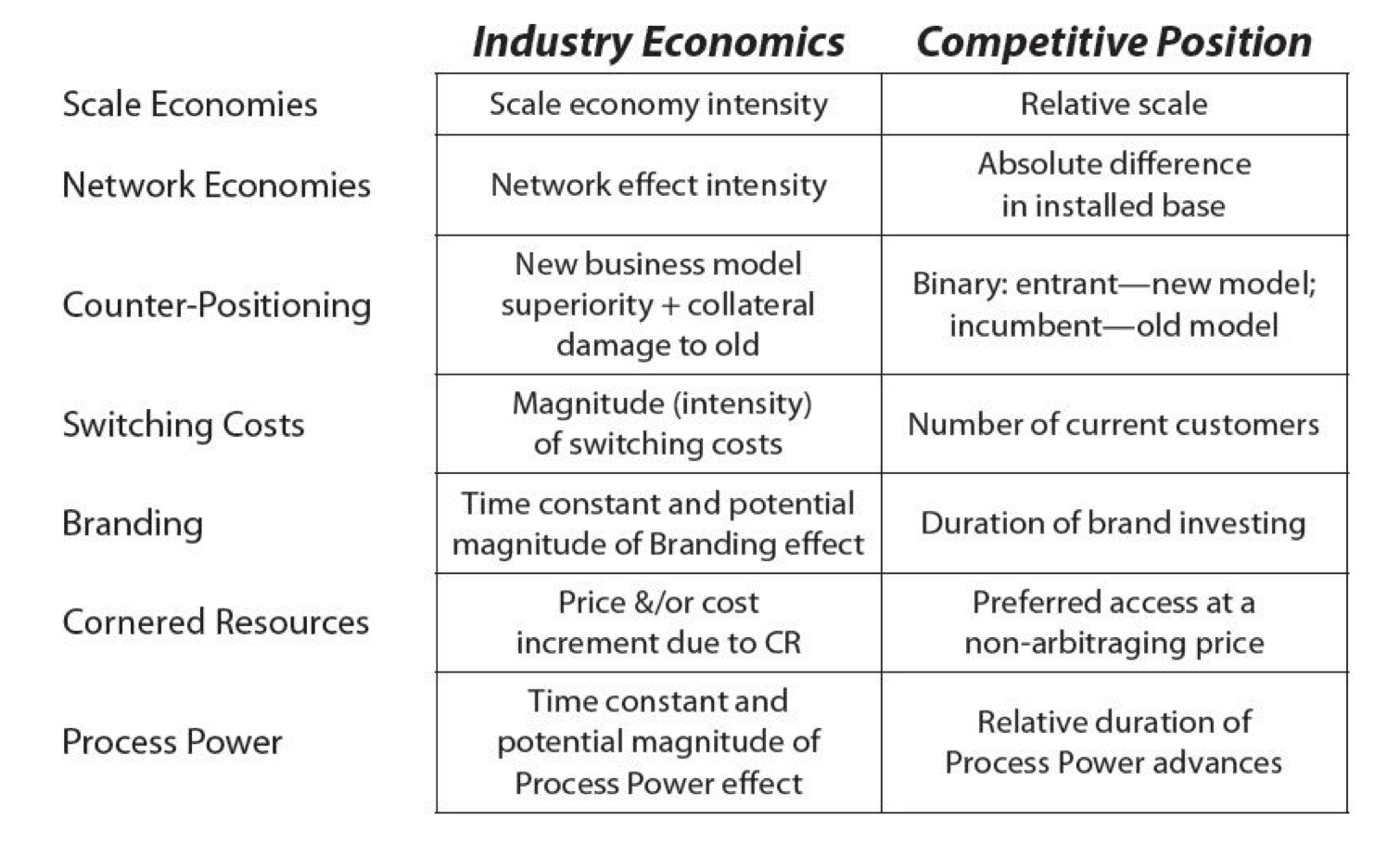

Power Intensity can be outlined in a table:

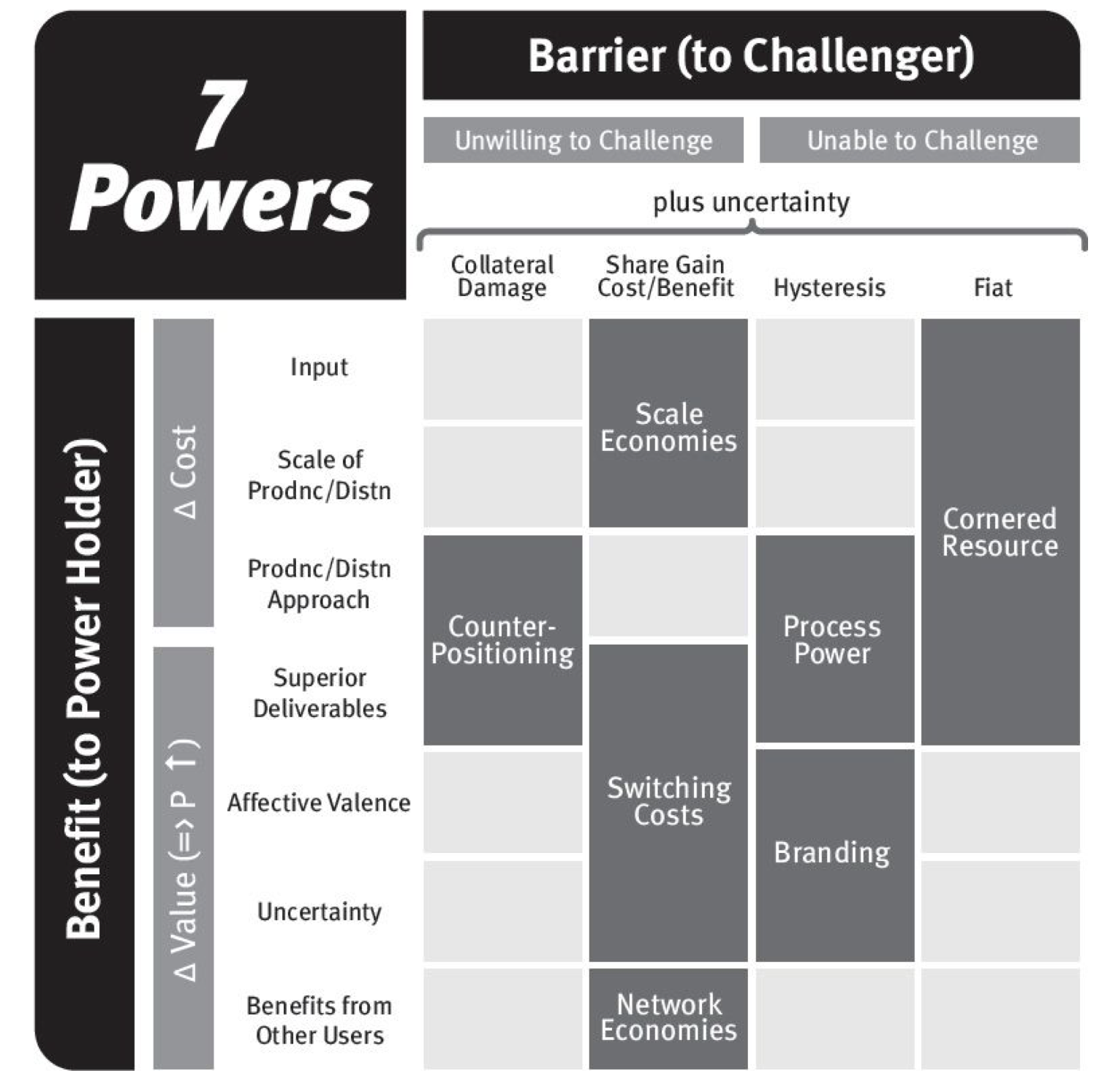

The Benefits and Barriers to Power can be summarized in a diagram:

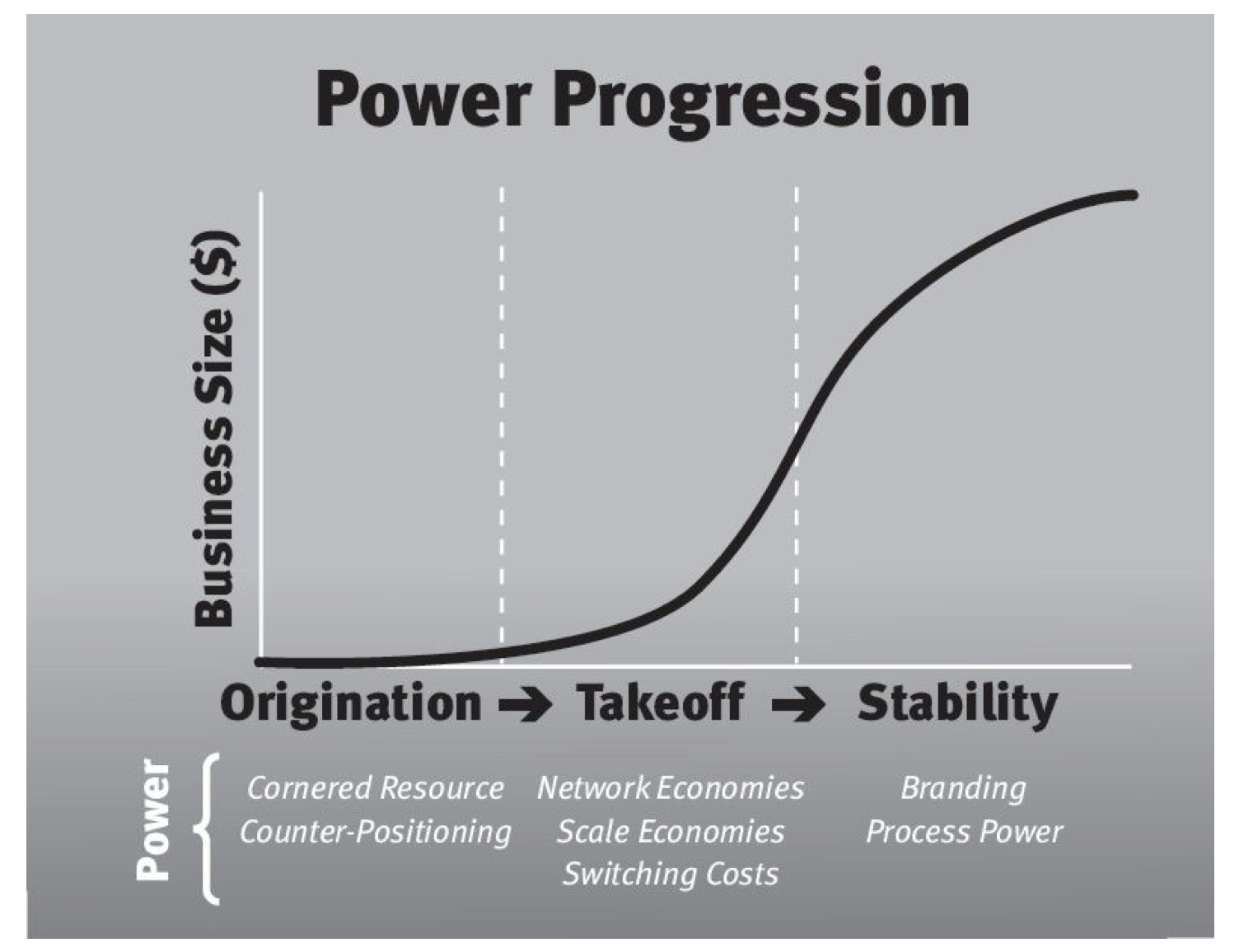

Power Progression

The author caps the book off with a description of Power Dynamics. How to get there from here.

At Origination, a firm must start with a Cornered Resource or Counter Positioning. Then at Takeoff, the firm must build Network Economies, Scale Economies, or Switching Costs. And when the firm reaches Stability, the firm must create Branding and Process Power.